bbmptax karnataka gov in – Property Tax Payment Online Bangalore [Receipt] – A direct tax levied Karnataka State Government and collected by local organisations BBMP Property Tax 2023. Mainly assessed against real estate, which includes bare ground. Both online and offline methods are used by BBMP to collect property taxes. Collecting property taxes, BBMP makes sure public amenities and infrastructure are properly maintained, including local roads, parks, and cleanliness.

bbmptax karnataka gov in – Property Tax Payment Online Bangalore

Amount BBMP property tax varies by location. Apartments, flats, stores, godowns, vacant land, and independent buildings (both residential and commercial) are some properties covered by BBMP Bangalore property tax ambit. Each year, Bruhat Bengaluru Mahanagara Palike, Bengaluru municipality body, must receive BBMP property tax payments property owners in Bangalore (BBMP). Property tax can be paid by citizens online. Property tax computed by BBMP using Unit Area Volume (UAV).

Collect Details For BBMP property tax online

| Name of Department | Property Tax System |

| Well Known | BRUHAT Bangalore MAHANAGARA PALIKE |

| Article Name | bbmptax karnataka gov in – Property Tax Payment Online Bangalore [Receipt] |

| Year | 2023 |

| Mode of Downloading Receipt | Online Mode |

| Category | Downloading |

| State | Bangalore |

| Aim | civic facilities in Bangalore |

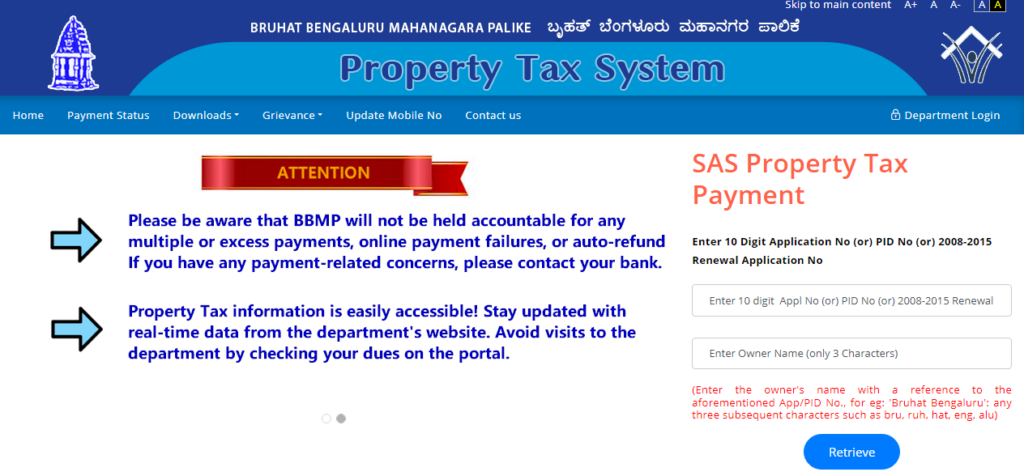

| SAS Property Tax Payment | PID Number and Owner Name |

| Official website | bbmptax.karnataka.gov.in |

bbmptax karnataka gov – संपत्ति कर भुगतान ऑनलाइन बैंगलोर [रसीद]

यूएवी संपत्ति में आने वाले रिटर्न, संपत्ति के मूल्य स्थान और संपत्ति के उपयोग पर आधारित है। संपत्ति कर मौजूदा संपत्ति कर मूल्य प्रति यूनिट वर्ग फुटेज से गुणा करके निर्धारित किया जाता है। छह क्षेत्र बीबीएमपी के अधिकार क्षेत्र का निर्माण करते हैं, और वे उन मार्गदर्शन मूल्यों पर आधारित होते हैं जिन्हें स्टाम्प और पंजीकरण विभाग ने स्थापित किया है। बैंगलोर में संपत्ति कर अपने और किराए के घरों के लिए अलग-अलग हैं, और दरें ज़ोन के अनुसार अलग-अलग हैं। आपके पास टैक्स का भुगतान ऑफलाइन या ऑनलाइन करने का विकल्प है।

BBMP Property Tax 2023 Payment

Property tax paid yearly to BBMP. BBMP property tax payment cycle runs from April to March each year, and must be paid in full by April 30 following year. Due to Coronavirus epidemic previous fiscal year, BBMP extended a 5% BBMP property tax rebate until May 31st. Taxes in full due date in one installment are eligible 5% BBMP property tax online rebate. When paying BBMP property taxes late, interest rate of 2% per month assessed. Moreover, the BBMP property tax can be paid in two equal payments without interest or rebates.

BBMP Property Tax Rebate

Bangalore residents who pay property taxes in one lump sum are eligible BBMP property tax rebates. You will receive a 5% tax discount in situation. BBMP property tax, instance, Rs 1000 and you pay entire amount in one instalment, you will receive 5% back, which means you will only owe Rs 950.

Check BBMP Property Tax 2023 Rates

BBMP Property Tax Rates 2022-23 (Zone-wise)

Zone A

- Self-Occupied Property (Rs per sq ft): 2.80

- Tenanted (Rs Per Sq ft): 05

Zone B

- Self-Occupied Property (Rs per sq ft): 02

- Tenanted (Rs Per Sq ft): 04

C Zone C

- Self-Occupied Property (Rs per sq ft): 1.80

- Tenanted (Rs Per Sq ft): 3.60

Zone D

- Self-Occupied Property (Rs per sq ft): 1.60

- Tenanted (Rs Per Sq ft): 3.20

E Zone

- Self-Occupied Property (Rs per sq ft): 1.20

- Tenanted (Rs Per Sq ft): 2.40

Zone F

- Self-Occupied Property (Rs per sq ft): 01

- Tenanted (Rs Per Sq ft): 02

How To Download Property Tax Payment Online Bangalore Receipt?

- Access BBMP’s official website by going to bbmptax.karnataka.gov.in and logging in.

- On home page, select the “Downloads” tab.

- You can print or download BBMP property tax receipts like Printed receipt, Print a Challan and Software Print

- BBMP property tax receipt can be downloaded by selecting desired button.

BBMP property tax online Payment Status

- Visit BBMP’s official website by going to https://bbmptax.karnataka.gov.in and logging in.

- On home page, click ‘Payment Status’ tab.

- You’ll be taken to next window after redirect.

- BBMP payment status can be looked application ID, Transaction or Challan Number

- Click retrieve button after choosing relevant choice. Information will be shown on screen.

Important Links For bbmptax karnataka gov in

- Apply online for BBMP property tax online Payment Status – Click Here

Mode of BBPM Property Tax Payment Status is an online mode

Official website of BBPM Property Tax is bbmptax.karnataka.gov.in

Details required To check bbpm Property Tax are PID Number and Owner Name