{www.jansuraksha.gov.in} Atal Pension Yojana 2023 – Application Form, Details, Eligibility, Apply Online through official website. Check PM Atal Pension Yojana Complete Information on this page.

Atal Pension Yojana 2023 Online Apply – www.jansuraksha.gov.in [Application Form]

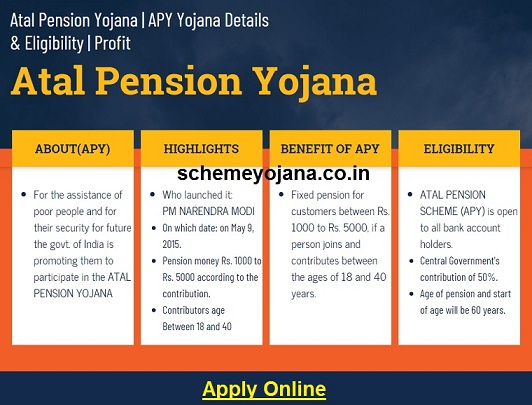

Atal Pension Yojana 2023 Form Online Apply (APY Scheme) – Those who are working in a place where they are not receiving PF amount or they are working in an unorganized company, and then they can apply in the Atal Pension Yojana 2023. The Atal Pension Scheme is replaced with the previous scheme Swavalamban Yojana. How can you apply for Atal Pension Yojana? What should be the qualification? Through this article, you can get answers to all these questions.

www.pfrda.org.in Atal Pension Yojana (APY) 2023 – {Main Objective}

The main objective of APY is to provide pension facility to the people working in unorganized company at the time of completing of 60 years. Under this scheme, along with the amount you deposit, the Government also contributes 50% of the total contribution, or Rs 1000 per month, whichever is lower in your pension account on its behalf. This Atal Pension Yojana is a security given as pension after you reach the age of 60 so that you can use it for any health issue or other works. The collected amount under this scheme should be managed by the Pension Fund Regulatory Authority of India (PFRDA).

Atal Pension Yojana 2023 Eligibility Criteria

Here we provide some eligibility criteria which are required to fulfill for all the candidates who want to apply for the Atal Pension Scheme 2023.

- The person who wants to apply must be an Indian citizen.

- The age limit of the candidate must be between 18 to 40 years old.

- The contribution should be making for a minimum of 20 years.

- A bank account is required. (This is linked with the Aadhar card).

- Valid Mobile Number.

- Candidates not already have an APY Account.

How To Apply Online For Atal Pension Yojana 2023 – Registration Process

Candidates who want to apply for this scheme are required to follow the below-mentioned steps:-

- Candidates can apply in all nationalized banks for APY Account.

- The applicant can also apply online for the Atal Pension Scheme 2023 through the official site.

- The APY Forms are also available in different languages such as English, Hindi, Bangla, Gujarati, Kannada, Marathi, Odia, Tamil, and Telugu.

- The application form is required to fill by the candidate and then submit it to your bank.

- The valid number also required to provide to the bank.

- A photograph of the Aadhar card is necessary.

The candidates get the confirmation message after approval of the application.

{APY} Atal Pension Yojana Contribution Chart

| Age of entry | Years of contribution | Monthly pension of Rs.1000/- | Monthly pension of Rs.2000/- | Monthly pension of Rs.3000/- | Monthly pension of Rs.4000/- | Monthly pension of Rs.5000/- |

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 224 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 752 |

| 34 | 26 | 165 | 330 | 495 | 659 | 824 |

| 35 | 25 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1196 |

| 39 | 21 | 264 | 528 | 792 | 1054 | 1318 |

| 40 | 20 | 291 | 582 | 873 | 1164 | 1454 |

Atal Pension Yojana Penalty Amount

If any candidate delayed in the payment of Atal Pension Scheme then he will be charged under below mentioned table:-

| Contribution up to Rs. 100 Per Month | Rs. 1 as Penalty |

| Contribution between 101 to 500 Per Month | Rs. 2 as Penalty |

| Contribution between 500 to 1000 Per Month | Rs. 5 as Penalty |

| Contribution between 1001Per Month | Rs. 10 as Penalty |

Benefits of Atal Pension Yojana (APY) 2023

- The candidate has a guarantee to receive per month pension after retirement from the government.

- Under Section 80CCD, Individual are eligible to take the benefit of the Atal Pension Scheme.

- All bank account holders can apply for the APY Scheme.

- The pension amount will be started after the age of 60 years of the individual.

- Private sector employees who are not receiving any pension amount now can get a pension from this scheme.

The pension amount can be withdrawal after getting the age of 60 years and if the individual dies before the age of 60 then your spouse can get the pension. If your spouse also dies then-nominee can get the pension and also he can continue the APY Account. The Atal Pension Scheme is a risk-free scheme where the candidate gets the pension amount after the age of 60 years.

| APY Scheme Additional Information | Click Here |

1 thought on “{www.jansuraksha.gov.in} Atal Pension Yojana 2023 – Application Form, Details, Eligibility, Apply Online”